Before I talk about why the debt as a percentage of GDP is irrelevant I'd like to update you on the ads that I have placed on my site. While ads are not the most pleasant thing to look at I have decided to donate a portion of the proceeds from them to help lower the debt and perhaps to also fund other anti-debt activities. All just depends on how much they make. If you would be interested in making a contribution to lower the debt, something I would encourage you to do, you can visit the Bureau of the Public Debt. Even if it is only to make a statement about your views on the debt your contribution matters.

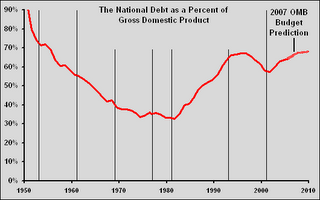

Often times I hear politicians and their supporter trying to defend government spending with the argument that since the debt as percentage of GDP is relatively low compared to past levels that it is not a big deal. This is not true for several reasons, the debt as a percentage of GDP was high either because we were suffering a from economic hardships (i.e: the Great Depression) and had a lower GDP or because of emergency one time spending (and no despite what the President says the spending in Iraq is neither emergency or one time), during these periods of high debt to GDP ratios taxes where high, and the economy was booming. Unfortunately those facts do not hold true today. The more important issue is how much are debt is growing (or shrinking) by. Right now we are experiencing record deficits each year. In fact, at the rate we are going every cent of tax revenue that goes to Washington will be used to pay interest on the debt. That is the point at which, at least in theory, that the price of our debt collapses along with our economy. That is not exactly a pleasant scenario and since 90% of our debt is held overseas we wouldn't be able to call on patriotic Americans to forgive the debt that they held. The fact in this matter is the debt is to our country much like steroids are to an athlete, in the short term we will enjoy a minor boost in our performance but, in the long term we are killing ourselves. There are many more scary statistics on the debt but, I think I have given you enough information to see that the debt is a bigger problem than we make it to be so I will spare you the long list. Just remember: as long as we take tax breaks and spending increases from politicians in exchange for our votes this problem will not get better.

After these first few posts about the debt I hope I can start blogging about my journey fighting it. That will be a lot more interesting than statistics predicting our doomsday.

I'd also like to share with you how much certain economic groups got from the Bush tax cuts.

Cost of the Bush Tax Cuts 2001-2005

Economic Group ____2001____ 2002____ 2003 ____2004____ 2005

(In billions of dollars)

Lowest 20%_______ $1____ $2______ $2____ _$2_____ $2

Second 20%_______ $7 ____$7______ $8_____ $8____ $10

Middle 20%____ ___$11 ____$11 ____ $11 ____$12 ____$14

Fourth 20%_______ $15____ $16____ $17____ $19____ $22

Next 15%_________ $15____ $18____ $19 ____$24____ $27

Next 4%__________ _$5 ____ $9 ____$9 ____ $13 ____$10

Top 1%__________ $4____ $15____ $15____ $26____ $25

Source: http://ctj.org/